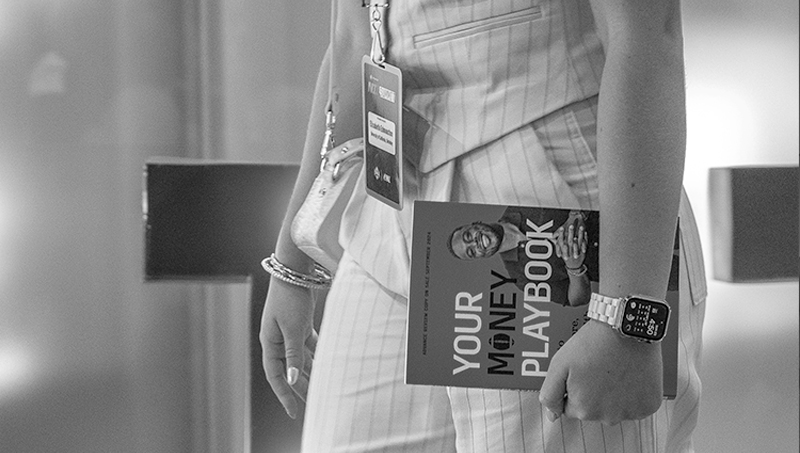

YOUR MONEY PLAYBOOK

Unlock Your

Financial

Potential

with

Your Money

Playbook

by

Brandon

Copeland

A VISION WITHOUT ACTION IS MERELY A DREAM

"If you’re on a mission to become financially free, then this experience is going to have to be more than just reading a book for you."

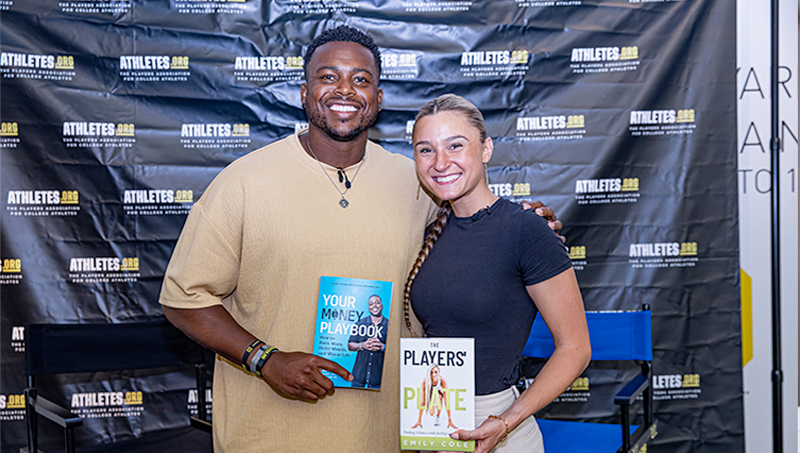

Brandon Copeland has always been different. His determination to succeed and create the life he wanted launched him from Baltimore to the University of Pennsylvania and then to the NFL. Over his ten-year playing career, he saved and invested the majority of his earnings, created other business opportunities, and motivated his teammates as the locker room’s money professor. He returned to the same Ivy League classrooms midway through his football career to launch his Life 101 financial education platform, reaching thousands of students in-person and online.

Now, in this guide, Copeland breaks down his life-changing course into four digestible quarters:

- The Art of Hustle—optimizing opportunities and generating multiple streams of income.

- The Power of Growth—demystifying investing and making money work for you.

- The Commitment to Smart Spending—saving on major expenses and reducing everyday costs.

- The Promise of Legacy—unpacking dreaded topics like insurance, wills, and estate planning.

Your Money Playbook is a bold, practical, and action-oriented blend of candid introspection and strategy to help readers confront their financial insecurities and commit to building new, game-changing mindsets and practices. This accessible and inspirational guide puts the playbook for creating the life you’ve always imagined right in the palm of your hands.

"I want to show you how you can leverage your greatest asset—you—to make smart money moves, reduce the stress that comes with financial challenges, solidify your future, grow your wealth, and create the life of your dreams."

KEEP GOING,

KEEP GROWING

Take your Financial Education to the next level. Take Cope's widely-popular Life 101 course from the comfort of your home.